Established as one of the most sought-after online betting platforms, 1Win Casino has steadily carved its niche in the global gambling arena. Catering to both novices and seasoned professionals, this article provides an in-depth analysis of the platform’s offerings, ranging from its captivating 1Win casino games to the thrill of 1Win betting.

1Win: Company Insight

In the digital age, choosing a reliable betting platform is crucial. Among the plethora of choices, 1Win emerges as a frontrunner, promising not just engaging games but a holistic online gambling experience. Whether you’re aiming for the jackpot 1Win offers, or simply exploring various games, the platform ensures top-notch quality in every aspect. 1Win online presents a seamless interface, enriched with vibrant graphics that enhance the user experience.

As enthusiasts might be aware, the process to 1Win sign up is straightforward. For those who wish to indulge in mobile gaming, the platform also offers dedicated apps to elevate the gaming experience. If you’re curious about the diverse options, from 1Win slots to live games, continue reading for a comprehensive insight.

Overview of 1Win Casino

In the digital age, choosing a reliable betting platform is crucial. Among the plethora of choices, 1Win emerges as a frontrunner, promising not just engaging games but a holistic online gambling experience. Whether you’re aiming for the jackpot 1Win offers, or simply exploring various games, the platform ensures top-notch quality in every aspect. 1Win online presents a seamless interface, enriched with vibrant graphics that enhance the user experience.

As enthusiasts might be aware, the process to 1Win sign up is straightforward, allowing users to dive into their favorite games without unnecessary delays. For those who wish to indulge in mobile gaming, the platform also offers dedicated apps to elevate the gaming experience. If you’re curious about the diverse options, from 1Win slots to live games, continue reading for a comprehensive insight.

Company History and Background

While 1Win Casino has rapidly gained popularity in recent times, its roots trace back to year, when a group of gambling enthusiasts decided to launch a platform that prioritizes user experience. Starting with a handful of games, the platform expanded its horizons, incorporating innovative games and betting options to cater to a global audience.

The platform’s user-friendly design ensures that both beginners and seasoned gamblers can navigate and play 1Win casino games effortlessly. Ensuring fair play, 1Win integrates RNG (Random Number Generator) in its games, promoting an unbiased gaming experience for all. So, whether you’re aiming for big wins or looking for casual entertainment, 1Win Casino is your one-stop destination.

The journey from inception to becoming a top-rated platform wasn’t smooth. However, 1Win’s dedication to offering quality ensured its steady rise in the industry. Today, when someone mentions 1Win casino, it resonates with reliability, diversity, and unmatched gaming experience. With its commitment to responsible gambling and transparent operations, the platform has earned the trust of millions worldwide. As we delve deeper into its features and offerings, it’s clear why 1Win Casino is often the first choice for many gambling aficionados.

Is 1Win Legitimate and Secure?

Security remains a paramount concern for online gamblers. In this digital era, the importance of choosing a secure and legitimate platform cannot be understated. So, let’s dive into 1Win’s security protocols and its legitimacy.

Legal Status of 1Win

The 1Win casino operates under the jurisdiction, backed by all necessary licenses and certifications, making it a legitimate platform for betting and gambling. Always remember to check for licenses and regulatory compliance when choosing a platform for gambling. This ensures a safe environment and lawful operations.

Security Measures at 1Win

In the vast online world, the safety of user data and funds is crucial. 1Win employs advanced security measures to ensure that users can play without any apprehensions.

| Security Feature | Description |

| SSL Encryption | All data transferred between the user and the 1Win online server is encrypted using SSL, making it nearly impossible for hackers to intercept. |

| Two-Factor Authentication (2FA) | Offers an additional layer of security, ensuring that even if someone knows your password, they can’t access your account without a second verification step. |

| Regular Audits | 1Win undergoes routine audits by third-party agencies to ensure that their systems are safe and that they adhere to international standards. |

Such robust measures instill confidence in players, making 1Win a preferred choice for many.

1Win’s Licensing and Regulation

Licensing and regulation play a pivotal role in determining a casino’s credibility. Let’s dive deeper into 1Win’s licenses and its adherence to regulatory standards.

Licensing of 1Win

1Win casino operates under a stringent regulatory framework. Its licenses are testimony to its commitment to fair play and user security.

These licenses guarantee that the platform operates within legal confines, offering players a safe environment for gambling.

Regulatory Compliance

Being licensed is just the first step. Ensuring regular compliance with the stipulated guidelines is what sets a platform apart.

- 1Win undergoes routine inspections to ensure adherence to the gambling guidelines set by international authorities.

- All games, including 1Win slots, incorporate RNG (Random Number Generators), ensuring fair play without any manipulation.

- The platform maintains transparency in its operations, ensuring players have access to their transaction histories and game outcomes.

By maintaining such high standards, 1Win ensures trust and reliability, cementing its position as a top-tier betting platform.

1Win Casino Selection

The diverse range of games is one of the major attractions of 1Win casino. From traditional favorites to innovative new games, 1Win offers an array of options to satisfy every gambler’s taste.

Poker

1Win takes poker to the next level. With multiple variations available, players can indulge in their favorite type or explore new versions.

- Texas Hold’em

- Omaha Poker

- Seven-Card Stud

- Razz Poker

- Five Card Draw

Poker tournaments are frequent, offering players the opportunity to test their skills and win big.

Roulette

Roulette, the classic casino game, finds its place in 1Win with multiple rooms and bet limits. Players can choose from:

- American Roulette

- European Roulette

- French Roulette

With stunning graphics and real-time action, the thrill of roulette is ever-present on 1Win online.

Slots

The exciting world of 1Win slots beckons with its vibrant themes, soundtracks, and massive jackpots.

- Mystical Fortunes.

- Aztec Gold.

- Space Adventures.

With hundreds of slots, there’s a game for everyone, from the casual player to the seasoned gamer.

Live Casino Games

Experience the brick-and-mortar casino atmosphere from the comfort of your home with 1Win’s live casino offerings. Real dealers, real-time action, and interactive gameplay make the live casino a hit among players.

- Live Blackjack

- Live Baccarat

- Live Roulette

- Live Poker

The immersive experience, combined with the chance to interact with dealers and players, sets the 1Win game live casino apart.

Registering with 1Win

Joining the 1Win community is straightforward. New users can complete the 1Win sign up process within minutes by following a few simple steps:

- Visit the official 1Win website or app.

- Click on the ‘Register‘ or ‘Sign Up‘ button.

- Provide the required details.

- Verify your email or phone number.

- Set a password for your login 1Win account.

- And voila! You’re ready to explore and play 1Win casino games.

Ensure you’re above the legal age for gambling in your jurisdiction when registering.

1Win Login Assistance

Forgetting passwords or facing login issues is common. Fortunately, 1Win’s platform offers quick assistance. If you encounter difficulties with login 1Win, follow these steps:

- Click on the ‘Forgot Password?’ link on the login page.

- Enter your registered email or phone number.

- Follow the instructions sent to your email or via SMS to reset your password.

- Log in with the new password and enjoy 1Win betting.

If the problem persists, reach out to their customer support for immediate resolution.

Welcome Promotions at 1Win

Ensuring a smooth financial transaction process is paramount for 1Win. With various deposit and withdrawal methods, managing your funds on the platform is effortless. 1Win understands that every user has different preferences when it comes to financial transactions. Hence, the platform has integrated a wide range of payment methods, ensuring that there’s something for everyone. Whether you prefer traditional bank transfers, modern e-wallets, or even cryptocurrency, 1Win has got you covered.

Depositing funds is a breeze. Simply login 1win, navigate to the deposit section, select your desired payment method, and follow the on-screen instructions. The platform prides itself on its speedy deposit times, with most transactions reflecting in your 1Win account within minutes. When it’s time to withdraw your winnings, the process is just as straightforward. Go to the withdrawal section, choose your preferred method, and enter the amount you wish to withdraw. 1Win’s commitment to transparency ensures that there are no hidden fees or charges. However, it’s always a good idea to check with your payment provider for any potential external fees.

Security is a top priority for 1Win. The platform employs the latest encryption technologies to ensure that users’ financial data remains confidential and protected. Regular audits and compliance checks further bolster the platform’s dedication to safeguarding its users’ funds. Moreover, 1Win provides users with detailed transaction histories, allowing them to track their deposits, withdrawals, and wagers with ease. This feature is especially handy for those who like to keep a close eye on their betting budget and strategies. In the rare event that you encounter any issues or have queries regarding your transactions, 1Win’s dedicated customer support is always ready to assist. With their multi-channel support, solutions are just a message or call away.

Betting Welcome Offer

Avail the betting welcome offer to kickstart your journey. After registering, make your first deposit and receive a bonus amount to enhance your betting experience.

Betting welcome offers are incentives provided by bookmakers to attract new users. These are typically available to customers upon registration and making their first deposit.

Key Features:

- Matched Deposit: Bookmakers may offer to match a user’s first deposit by a certain percentage, up to a maximum amount. For example, a 100% matched deposit up to $100 would mean if you deposit $100, you’ll receive an additional $100 in bonus funds.

- Free Bets: After placing a qualifying bet, the user might receive free bets. This could be a single bet or multiple smaller bet tokens.

- Risk-Free Bets: Here, if a user’s first bet loses, the stake is refunded as cash or as a free bet, up to a certain value.

Casino Welcome Incentive

For those inclined towards casino games, 1Win offers a casino-specific welcome bonus. This incentive matches your initial deposit, granting you extra funds to play 1Win casino games.

Casino welcome incentives are bonuses given to new users upon signing up for a casino platform or making their first deposit. They are designed to provide players with additional funds or opportunities to play and explore the platform.

Key Features:

- Deposit Bonuses: Similar to betting, casinos might offer to match a player’s deposit by a certain percentage. For example, a 200% bonus up to $200 would give a player $400 to play with after depositing $200.

- Free Spins: Players might receive a specified number of free spins on certain slot games.

- No Deposit Bonuses: Some casinos offer bonuses just for registering, without requiring a deposit. This might be in the form of bonus funds or free spins.

Tips:

- Wagering requirements are common with casino bonuses. This means you might need to bet the bonus amount a certain number of times before withdrawal.

- Game restrictions may apply. Bonus funds or free spins might only be valid for certain games.

1Win Promotional Code

Periodically, 1Win introduces promotional codes for exclusive bonuses. Keep an eye on their promotions page or subscribe to their newsletter to grab these 1Win bonuses.

1Win, like many other betting platforms, may offer promotional codes to both new and existing users. These codes can unlock special offers, enhanced odds, or deposit bonuses.

How to Use:

- Find a Code: This might be provided directly by 1Win, through affiliate partners, or via promotional campaigns.

- Enter the Code: During registration or deposit, there will be an option to input a promotional code.

- Activate: Once the code is entered and confirmed, the associated bonus or offer will be activated on the user’s account.

Tips:

- Always check the validity of a promotional code. Some might be time-sensitive or event-specific.

- Ensure you understand the terms linked to the promotional code, such as any wagering requirements or restrictions.

Always remember to gamble responsibly and be aware of the terms and conditions attached to any promotional offers.

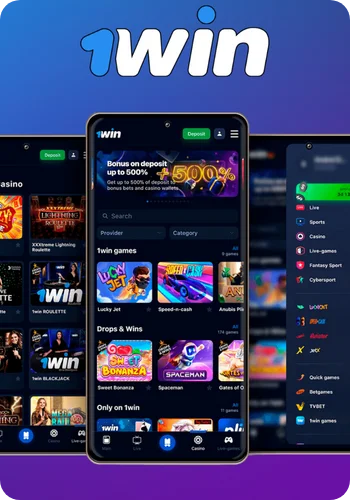

1Win Bet on Mobile Devices

1Win ensures you don’t miss out on any action. The platform’s mobile compatibility is top-notch, making 1Win betting accessible and seamless. 1Win mobile app offers a comprehensive and user-centric betting experience for individuals who prefer the flexibility of betting from their mobile devices. With its intuitive interface, live betting options, diverse sports selection, and secure transaction process, the 1Win mobile app has become a popular choice among sports betting enthusiasts, allowing them to stay connected to the world of sports and betting wherever they go.

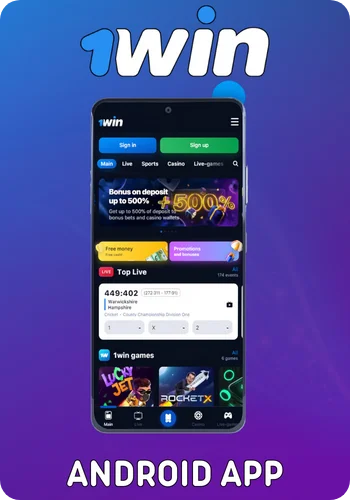

Android App for 1Win

The dedicated Android app offers an intuitive user interface, ensuring that players have the best experience. Download it directly from the official website, install, and dive into the vast world of 1Win online gaming and betting.

- Intuitive User Interface: Designed for a seamless user experience.

- Ease of Download: Available directly from the 1Win website.

- Installation Process: Simple and straightforward for Android devices.

- Access to Games and Betting: Wide range of 1Win online games and betting options.

- Optimized for Android: The app works efficiently on Android smartphones and tablets.

- Download Link: Download 1Win App

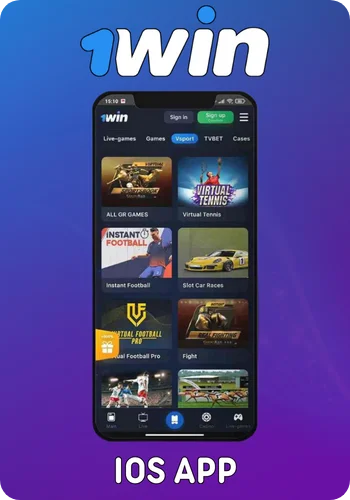

iOS App for 1 Win

iPhone users aren’t left out. The iOS app, available on the official 1 Win website is optimized for both iPhones and iPads. With a few taps, access the full range of 1Win casino games and betting options.

- Availability: Accessible on the App Store for iOS devices.

- Device Compatibility: Fully optimized for both iPhones and iPads.

- Convenience: Easy to download and install.

- Range of Games: Offers the full spectrum of 1Win casino games and betting options.

- User-Friendly Interface: Designed for ease of use and a seamless experience on iOS.

- Quick Access: Enables users to quickly dive into games and betting with just a few taps.

Managing Funds on 1Win

Ensuring a smooth financial transaction process is paramount for 1Win. With various deposit and withdrawal methods, managing your funds on the platform is effortless.

Website Layout and User Experience

The website boasts a clean and intuitive layout. The color scheme is pleasing to the eye, ensuring users spend hours on 1Win casino games without feeling overwhelmed.

Menus are clearly defined, making it straightforward to jump from sports betting to casino games or live events. Plus, the search functionality facilitates quick access to your favorite games or sports events.

Whether you want to play 1Win casino games or place a bet, the user experience is seamless, with minimal lag or loading times.

Navigational Features

Navigating through the vast offerings of 1Win is a breeze, thanks to its efficient navigational tools. Quick links, a responsive search bar, and categorized sections ensure you find what you need in seconds.

The site provides useful tooltips and guides, especially beneficial for newcomers. These features allow users to understand the platform’s various aspects, from 1Win sign up procedures to withdrawing winnings.

Sports Wagering at 1 Win

1Win excels in providing an extensive range of sports betting options. From mainstream sports to niche events, there’s something for every enthusiast.

Cricket Betting

1Win offers a plethora of cricket betting options. From international tournaments to league matches, place your bets and enjoy the thrill of the game.

Cricket, often deemed the ‘gentleman’s game’, is a sport deeply rooted in history and tradition. Betting on cricket involves predicting match outcomes, individual player performances, and other match-specific events. Popular Markets:

- Match Winner: Bet on which team will win the match.

- Top Batsman: Predict who will score the most runs in a match.

- Top Bowler: Wager on who will take the most wickets.

- Total Runs: Over/Under bets on the total runs scored.

Tips:

- Understand pitch conditions – they greatly influence match outcomes.

- Consider the format (Test, ODI, T20) when betting.

- Look at head-to-head stats between teams.

Football Betting

Football, a global sensation, finds a significant spot on 1Win. Bet on your favorite teams, players, or even predict match outcomes, and bask in the exhilaration of each goal.

Football, or soccer, is the most popular sport globally, and its betting markets are vast. Popular Markets:

- Full-time Result: Bet on Home win, Away win, or Draw.

- Both Teams to Score: Predict if both teams will score.

- Total Goals Over/Under: Wager on the number of goals in a match.

- First Goal Scorer: Bet on who will score the first goal.

Tips:

- Analyze team form and recent performances.

- Check injury and suspension lists.

- Factor in home advantage.

Formula 1 Betting

1Win presents a thrilling opportunity to bet on Formula 1 races. From predicting pole positions to race winners, the platform covers all aspects of the sport. Gear up, choose your favorite driver, and immerse yourself in high-octane action.

- Race Winner: Predict which driver will win the race.

- Pole Position: Bet on who will start from the front in the race.

- Fastest Lap: Wager on the driver who will clock the fastest lap.

- Constructors’ Championship: Bet on the team to gather the most points over the season.

Tips:

- Track conditions can heavily influence car performance.

- Consider the reliability and performance of different car constructors.

- Driver form and experience at specific tracks matter.

MMA Betting

Mixed Martial Arts (MMA) has gained significant traction worldwide. 1Win’s betting platform offers a comprehensive list of matches and fighters. Whether you’re rooting for the underdog or the reigning champion, 1Win provides odds that heighten the excitement of each bout.

- Fight Winner: Predict which fighter will win.

- Method of Victory: Submission, KO/TKO, or decision.

- Round Betting: Wager on which round the fight will end.

Tips:

- Research fighters’ strengths, weaknesses, and fighting styles.

- Consider recent fight histories and any injuries.

- Look into the fighters’ training camps and preparation.

Tennis Betting

The elegance of tennis coupled with the platform’s user-centric design makes for an unmatched betting experience. From Grand Slams to regional tournaments, 1Win betting ensures fans are always in the heart of the action.

- Match Winner: Bet on who will win the match.

- Set Score: Predict the exact score in sets.

- Total Games: Over/Under betting on total games in a match.

- First Set Winner: Wager on who wins the opening set.

Tips:

- Player form is crucial, especially in Grand Slam events.

- Surface type (clay, grass, hardcourt) can influence outcomes.

- Check head-to-head stats between players.

E-Sports Betting with 1Win

The digital age ushered in the meteoric rise of E-Sports. 1Win has capitalized on this trend, offering odds on popular games like Dota 2, CS:GO, and League of Legends. Whether you’re a seasoned gamer or just venturing into E-Sports, 1Win bet provides an engaging platform to test your predictive skills.

- Rise of E-Sports: Embracing the popularity surge in competitive gaming.

- Variety of Games: Offers betting options on major games like Dota 2, CS:GO, and League of Legends.

- For All Gamers: Catering to both seasoned gamers and newcomers to E-Sports.

- Competitive Odds: Providing competitive betting odds for a range of E-Sports events.

- Engaging Platform: A user-friendly platform that enhances the E-Sports betting experience.

- Test Your Skills: Ideal for users looking to apply their game knowledge and predictive skills in betting.

Virtual Sports Wagering

Even when live sports are off-season, 1Win keeps the action alive with virtual sports. Dive into simulated matches, races, and tournaments. The graphics are lifelike, and the outcomes are generated using fair algorithms, ensuring every bet is as exciting as real-life events.

Live Betting and In-Play Features

The thrill of live betting is unparalleled. With 1Win’s in-play features, bettors can place wagers as the action unfolds. The odds change in real-time, reflecting the on-ground situation, offering a dynamic and immersive 1Win betting experience.

- Real-Time Odds: Odds update live as the game progresses, reflecting the current state of play.

- In-Play Betting: Allows bettors to place wagers during the game, adding to the excitement.

- Live Updates: Continuous updates on game developments and stats for informed betting.

- Wide Range of Markets: Various betting options available even after the game has started.

- Instant Settlements: Quick settlement of bets as soon as the outcome is determined.

- Live Streaming: Some events may offer the ability to watch live while you bet.

This live betting feature is ideal for those who enjoy the adrenaline rush of making decisions in real-time, as it combines the excitement of live sports with the challenge of strategic betting. It’s perfect for bettors who like to stay engaged with every twist and turn of the game.

Betting Options at 1Win

From singles to accumulators, 1Win offers diverse betting options suitable for both novices and professionals. The platform emphasizes flexibility, allowing bettors to customize their wagers according to strategy and risk appetite.

| Betting Option | Description |

| Singles | A single bet on one selection in an event. The return is based on the odds of the chosen outcome. |

| Accumulators | A bet involving multiple selections in different events. All selections must win for the accumulator to pay out. |

| System Bets | Bets placed on several combinations of events, offering a higher chance of winning though at reduced odds. |

| Chain Bets | A combination of bets linked together, where the stake and winnings from the first bet roll over to subsequent bets. |

| Lucky Bets | A series of bets combining singles, doubles, trebles, and accumulators for a set number of selections. |

| Patent Bets | A type of bet that includes all possible multiples (doubles, trebles, etc.) for a set number of selections. |

Placing a Wager with 1Win

1Win simply login and navigate to your preferred sports or casino game. The platform’s intuitive design makes placing a wager straightforward, even for beginners. Choose your event, select your odds, decide on a stake, and confirm your bet. It’s as simple and quick as that.

- Sign Up/Login: Start by creating an account or logging in.

- Navigate: Browse through the various sports and betting markets.

- Select: Click on your desired bet to add it to your bet slip.

- Stake: Input the amount you wish to bet.

- Confirm: Review your selections and place your bet.

Grasping 1Win Betting Odds

Understanding betting odds is crucial for a successful wagering experience. 1Win offers odds in various formats, catering to an international audience. Their helpful guides ensure even newcomers can quickly grasp the concept, optimizing their betting strategies for the best outcomes.

Odds represent the bookmaker’s view of an event’s likelihood. In 1Win, odds might be presented in fractional, decimal, or American styles.

- Decimal Odds: Represents the total payout (stake + profit). An odd of 2.00 means you get $2 for every $1 staked.

- Fractional Odds: Shows potential profit relative to stake. 3/1 means you profit $3 for every $1 staked.

- American Odds: Positive values (e.g., +200) indicate the profit on a $100 stake. Negative values (e.g., -150) represent the stake needed to win $100.

Betting Customization Tools

Every bettor has a unique approach, and 1Win respects that. Their betting customization tools allow users to tailor their wagers to their preferences. From adjusting stake amounts to combining bets for higher returns, the platform is built for flexibility.

- Cash Out: Allows bettors to secure a profit or limit a loss before an event concludes.

- Bet Builder: Lets bettors combine multiple selections from the same event into one bet.

- Edit Bet: Offers the flexibility to add, remove, or swap selections in an open bet.

- Live Streaming: Watch the action unfold in real-time while placing live bets.

Customer Assistance at 1Win

1Win prides itself on its impeccable customer service. Whether you have queries about 1Win bonuses, need assistance with 1Win sign up, or face issues during gameplay, their team is available around the clock to assist. Their multi-channel support, including live chat, email, and phone, ensures that every user’s concerns are addressed promptly.

| Support Channel | Description |

| Live Chat | Instant support available directly on the 1Win website for quick resolution of queries. |

| Email Support | For detailed inquiries or documentation, email support is available. Responses are typically detailed and timely. |

| Phone Support | A direct line to customer service for users who prefer verbal communication or have urgent issues. |

| FAQ Section | A comprehensive list of frequently asked questions for self-help and immediate answers to common queries. |

| Social Media Channels | Active support and engagement through platforms like Twitter and Facebook, offering updates and responsive communication. |

Reasons to Select 1Win

From its vast selection of sports and 1Win casino games to its user-friendly interface, there are myriad reasons to choose 1Win. The platform’s commitment to security, transparent transactions, and stellar customer support further cements its position as a top-tier betting platform.

Conclusion: The 1Win Advantage

1Win Casino and betting platform distinguishes itself in the crowded online gambling market with its comprehensive range of offerings and a strong focus on user experience. Its diverse selection of games, from engaging slots to adrenaline-pumping sports betting, caters to a wide spectrum of preferences, ensuring there is something for every type of gambler.

The platform’s commitment to security and fair play, coupled with its transparent operations, instills trust among its users. The convenience of its mobile applications, both for Android and iOS users, enhances accessibility and ensures a seamless gaming experience on the go. This positions 1Win not just as a gaming platform but as a comprehensive entertainment hub.

1Win’s attentive customer support, robust security measures, and ongoing commitment to improvement reflect its dedication to providing a superior gambling experience. Whether you’re a seasoned gambler or a newcomer to the world of online betting and casino games, 1Win offers a reliable, secure, and enjoyable platform to meet your gaming needs.