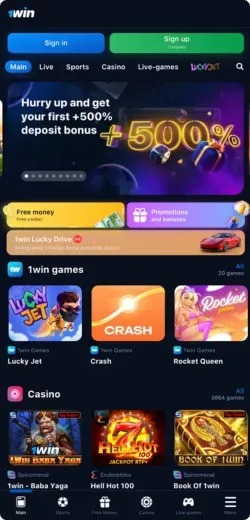

General Information about 1Win Casino

We operate under an international gaming license, offering services to players in India. 1Win India has been active since 2016 and underwent rebranding in 2018. Our platform includes casino games, sports betting, and a dedicated mobile application.

| Feature | 1Win Casino |

| License 📜 | N.V., Curacao License 8048/JAZ2018-040 |

| Mobile App 📱 | Available for Android and iOS |

| Casino Games 🎰 | Slots, blackjack, roulette, baccarat, jackpot games |

| Live Casino 🔴 | Live blackjack, live roulette, live baccarat, poker |

| Sports Betting ⚽ | Cricket, football, basketball, esports, tennis |

| Welcome Bonus 🎁 | +500% on the first 4 deposits |

| Minimum Deposit 💳 | 300 INR |

| Minimum Withdrawal 💸 | 950 INR |

| Currencies 💵 | INR, USD, EUR, RUB and other |

| Languages 🔤 | English, Hindi, Russian, Portuguese and other |

| Support 📞 | 24/7 Live Chat, Email |

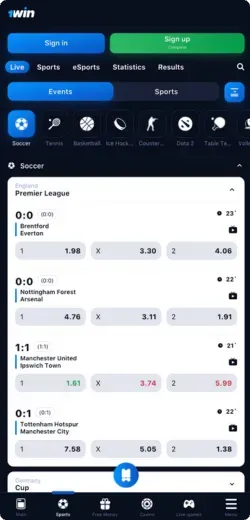

We offer extensive sports betting options, covering both local and international events. 1Win provides markets for cricket, football, and esports with various odds formats. Players can place wagers before matches or in real-time.

Legal Operation of 1Win in India

1Win Casino operates legally in India under offshore regulations, allowing users to access our platform without restrictions. The 1 Win online services, licensed by N.V. under Curacao License 8048/JAZ2018-040, comply with international gaming laws, making them accessible to Indian players. Local laws do not prohibit participation in online casinos registered outside the country.

Deposits and withdrawals on the 1Win website are processed through widely used payment methods in India. We provide financial transactions in INR, supporting multiple banking options for convenience. Our platform implements security measures to protect user data and funds.

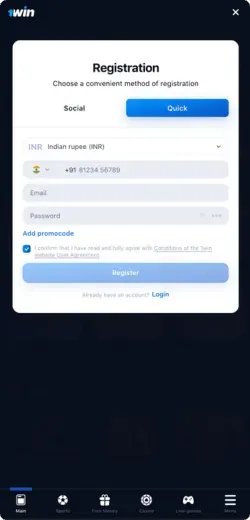

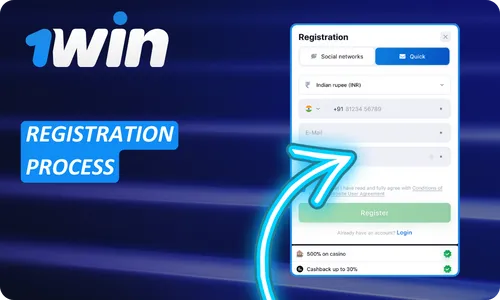

Registration Process at 1Win Website

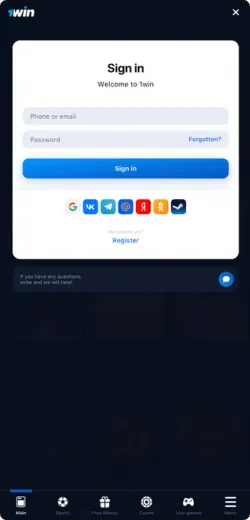

1Win provides a quick sign-up process for new users. Registration on the 1Win official site requires basic personal details and a valid payment method. Account verification may be necessary for withdrawals.

- Visit the original website and click on the registration button.

- Choose a preferred sign-up method: email, phone number, or social media.

- Enter required details, select a currency, and confirm registration.

- Make a deposit to activate the account and access betting options.

- Verify identity if requested to enable full account functionality.

Players can access their accounts from any device without restrictions. Transactions and betting options are available immediately after registration on 1Win com. Account security measures help protect personal and financial data.

Sports Betting

1Win covers more than 40 sports, offering various betting options for users in India. Cricket, football, and tennis are among the most popular categories on the 1Win India platform. Both pre-match and live bets are available with dynamic odds adjustments.

| Sport | Betting Options |

| Cricket 🏏 | Match Winner, Top Batsman, Over/Under, Live Betting |

| Football ⚽ | 1X2, Handicap, Total Goals, Both Teams to Score |

| Tennis 🎾 | Match Winner, Set Betting, Game Handicap, Live Bets |

| Esports 🎮 | Winner, Map Handicap, First Blood, Total Kills |

| Basketball 🏀 | Moneyline, Point Spread, Total Points, Quarter Betting |

Live betting allows users to adjust their wagers during ongoing matches. The 1Win Online platform provides real-time statistics and cash-out options. Odds are updated dynamically based on match progress and player performance.

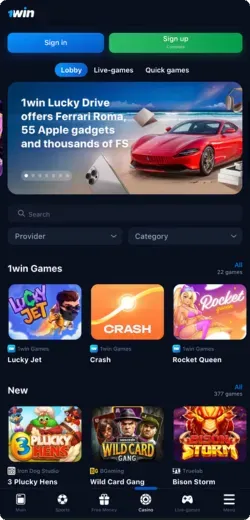

1Win Casino Games

Our platform offers over 5,000 casino games across various categories. The 1 Win website provides access to slots, table games, and live dealer options. Players at 1Win Casino can choose games from top providers with different RTP percentages.

- Slots: Classic, video, and jackpot slots with different volatility levels.

- Roulette: European, American, and French variations available.

- Blackjack: Standard, multi-hand, and VIP tables.

- Baccarat: Traditional and speed versions with real dealers.

- Poker: Texas Hold’em, Caribbean Stud, and video poker options.

- Crash Games: Popular fast-paced betting games with multipliers.

1Win supports instant-play games without additional software installation. The 1 Win game collection includes in-house titles like Lucky Jet and Rocket X, which match leading games in quality and feature high RTP rates. Live casino options feature HD streams and interactive dealer chats.

Live Casino

We provide live dealer games with real-time streaming and interactive features. The 1 Win official website hosts over 200 live tables, including popular 1Win games. Players can choose from multiple betting limits and engage with professional dealers.

- Live Roulette: European, American, and Lightning variations.

- Live Blackjack: Classic, VIP, and Party tables.

- Live Baccarat: Speed, Squeeze, and No Commission versions.

- Live Poker: Texas Hold’em, Three Card Poker, and Caribbean Stud.

- Game Shows: Monopoly Live, Crazy Time, and Deal or No Deal.

1Win offers high-definition streams with real-time action. The 1Win .com platform supports 1Win game tournaments with exclusive prize pools. Players can use chat functions to interact with dealers and other participants.

Bonuses and Promotions

Players can access multiple promotions for sports and casino games at 1Win official website. Bonus funds are credited to a separate balance and can be used for wagers.

| Bonus | Details |

| Welcome Bonus | +500% on the first 4 deposits |

| Promo Code | INDIA1WIN24 |

| Express Bonus | Extra profit percentage on winning accumulator bets (5+ events) |

| Casino Cashback | Up to 30% cashback on casino losses |

| Sports Free Bet | First deposit grants a free bet available in Live and Pre-match |

| Free Spins | 70 free spins for a deposit of 1300 INR or more |

| Loyalty Program | Earn 1Win Coins while playing and exchange them for rewards |

Promotional offers are updated regularly to provide additional value. The real website features seasonal bonuses for active players.

How to Get a Welcome Bonus?

New players can receive a deposit-based bonus after registration. The 1Win site provides up to +500% in additional funds on the first four deposits. Bonus amounts vary depending on the deposit sequence and are credited automatically.

- Create an account and make your first deposit.

- Receive +200% on the first deposit, +150% on the second, +100% on the third, and +50% on the fourth.

- Use the bonus funds for betting on casino games or sports events.

- Convert the bonus into real balance by meeting wagering requirements.

Bonus funds become available after completing the required bets. The 1 Win platform credits eligible winnings from bonus bets to the main account. All promotional terms, including wagering conditions, are available in the bonus section.

Deposit and Withdrawal

1Win provides various deposit and withdrawal options for Indian players. The minimum deposit starts at 300 INR, with different limits depending on the method. Cryptocurrency transactions are also supported for flexible payment processing.

| Method | Deposit Range | Withdrawal Range |

| PhonePe | ₹300 – ₹50,000 | – |

| PayTm | ₹300 – ₹50,000 | – |

| UPI | ₹300 – ₹50,000 | – |

| Bank Transfer | ₹300 – ₹500,000 | – |

| AstroPay | ₹390 – ₹600,000 | ₹950 – ₹80,000 |

| Bitcoin | 0.00010649 BTC | ₹9,565 – ₹900,000 |

| Tether | 5 USDT | ₹1,200 – ₹4,518,790 |

| Ethereum | 0.0038 ETH | ₹1,500 – ₹911,371.9 |

| IMPS | – | ₹1,200 – ₹50,000 |

| Perfect Money | – | ₹1,500 – ₹738,500 |

Processing times depend on the chosen payment method. Withdrawals using bank transfers or IMPS typically take a few hours. Cryptocurrency transactions provide faster payouts compared to traditional banking methods.

1Win Mobile Application

1Win offers a dedicated mobile application for convenient access. Players receive 200 1Win Coins on their bonus balance after downloading the app. The application provides a secure environment with encryption and regular updates.

The Android version is not available on Google Play but can be downloaded from the official website. iOS users can install the app directly from the App Store. The mobile application is optimized for performance and accessibility.

APK for Android

1Win provides an APK file for Android users to download directly. The app is not available on Google Play due to platform restrictions. Installation requires enabling downloads from unknown sources in device settings.

- Visit the official 1Win website on your Android device.

- Locate the APK download section and tap the download button.

- Go to your device settings and allow installations from unknown sources.

- Open the downloaded file and proceed with the installation.

- Launch the app, log in, and access all available features.

The APK provides full functionality, including deposits, withdrawals, and live betting. Regular updates maintain security and compatibility with Android devices. The app size is approximately 50 MB and is compatible with Android 5.0 and higher.

Download the Application for iOS

1Win provides an iOS application available for direct download from the App Store. The app supports all platform features, including account management and transactions. It is optimized for iPhones and iPads running iOS 12.0 or later.

- Open the App Store on your iPhone or iPad.

- Search for “1Win” in the search bar.

- Select the official app from the results and tap “Download.”

- Wait for the installation to complete, then open the app.

- Log in or create an account to start using all available features.

The application offers a responsive interface and fast navigation. Its file size is approximately 60 MB, ensuring quick installation. Regular updates enhance security and improve performance on iOS devices.

Customer Support

Players can contact customer support through multiple communication channels. The response time depends on the method, with live chat providing the fastest assistance. One of the common inquiries from users is whether is 1Win legal in India, and our team provides accurate information on regulations.

- Live Chat: Available 24/7 for immediate responses.

- Email Support: Assistance with account verification, transactions, and technical issues.

- Telegram: Direct communication with support for quick troubleshooting.

- WhatsApp: Fast response for mobile users needing direct assistance.

- Phone Support: Available during working hours for urgent matters.

- FAQ Section: Covers common topics such as deposits, withdrawals, and promotions.

- Social Media: Updates and limited support via official pages.

- In-App Support: Direct chat assistance within the mobile application.

Support agents assist with payment issues, game-related queries, and profile security. The 1Win owner confirms that customer inquiries are handled efficiently and professionally. Assistance is available in multiple languages, including English and Hindi.

Why Choose 1Win Among Other Bookmakers?

We offer a betting platform with extensive market coverage and competitive odds. The 1 Win sportsbook includes pre-match and live betting for various sports. Our promotions provide additional benefits to both new and existing players.

- Extensive Sports Markets: Covering cricket, football, tennis, and esports.

- High Odds: Competitive pricing for better potential returns.

- Live Betting: Real-time odds updates with cash-out options.

- Mobile Accessibility: Fully optimized apps for Android and iOS.

- Fast Withdrawals: Quick processing times for multiple payment methods.

- Bonuses and Promotions: Welcome offers, cashback, and free bets.

- Licensed Operations: Legal offshore betting access for Indian players.

- Customer Support: 24/7 assistance in English and Hindi.

Users have access to multiple transaction methods in INR for convenient transactions. One of the available mirror sites, 1Win Pro, provides an alternative entry point for uninterrupted access. Regular updates introduce new betting features and improve platform functionality.

Screenshots of 1Win India